How to raise a pre-seed round in crypto

Pierre Chuzeville from Lattice is sharing his latest pre-seed fundraising advice.

Jericho is the land of web3 founders. Meet, learn & build with 400+ hand-picked founders from 40+ countries who raised $450M in total from tier one VC funds.

This “Let’s Fucking Build” edition is brought to you by our two amazing partners:

Lattice is an early-stage crypto VC that helps founders build defensible moats. They write $500K-$1.5M checks into early Web3 companies. Portfolio: 50+ crypto companies including Immunefi, Layer3, and Project Galaxy.

Ledger Cathay Capital is a brand new €100m investment fund for Web3 entrepreneurs at Seed & Series A stage. They offer entrepreneurs the value of a leading global investment platform combined with the support of the world-leading Web3 security platform.

This article is a guest post from our friends at Lattice. Pierre Chuzeville is sharing his latest pre-seed fundraising advice in the piece below.

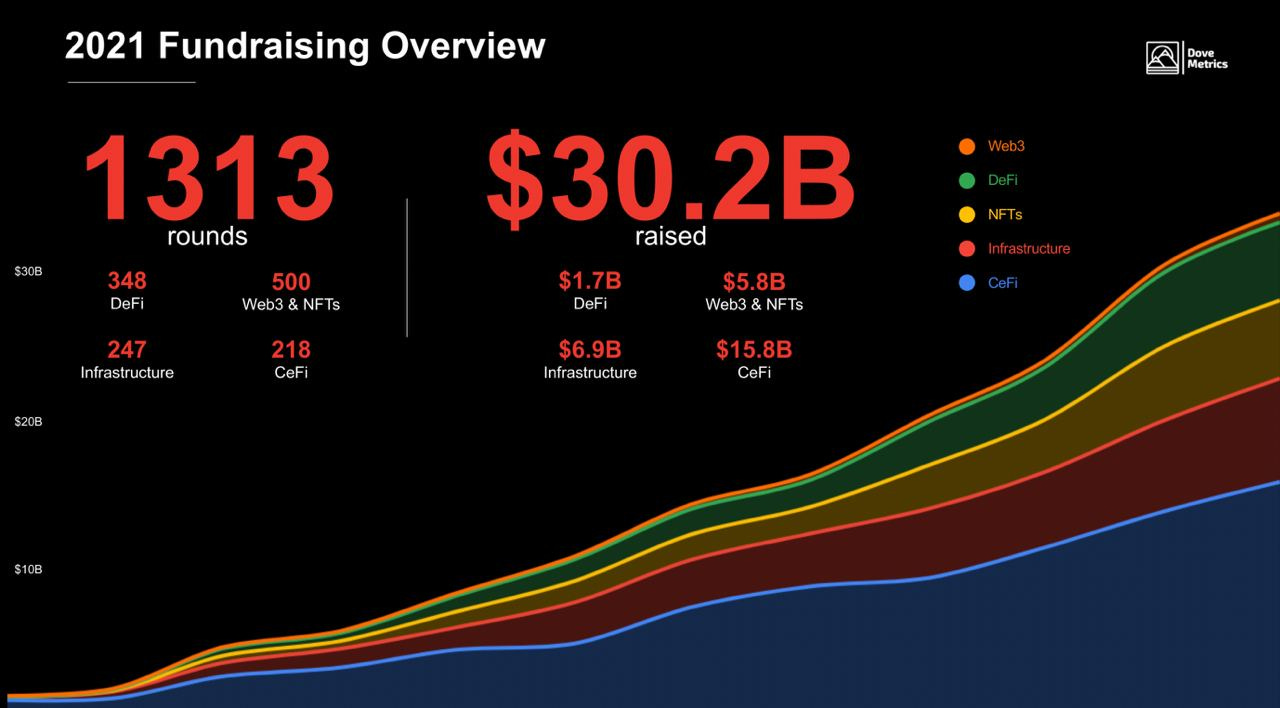

According to data from Messari, 1,700+ crypto funding rounds have been announced in 2022, for a total of $37B+ raised. Despite the challenging market conditions, it represents a ≃20% increase in value vs. 2021.

While there's plenty of news about big funding rounds, there's not enough attention given to the challenges that founders face in securing funding, especially in the early stages. Even though it's easier to raise funds now than it was a few years ago, founders still struggle to get the financial support they need.

Dove Metrics (acq. by Messari) was initially built to make crypto fundraising markets less opaque and founders’ lives easier. As pre-seed funding rounds are less likely to be announced, this funding data is helpful but not perfect.

This article aims at advising early-stage crypto founders to navigate the biggest unknowns. Accepting external investment is a crucial decision for founders, and they need to make it based on informed judgment.

Approaching pre-seed crypto investors

We published two VC maps – one is focused on the American market, and the other one is on Europe. Many funds listed are labeled as “early-stage” investors, but very few are primarily focused on pre-seed rounds.

First-check-focused funds must be able to bring something different to the table compared to more traditional seed funds. Pre-seed-stage crypto companies will certainly pivot (possibly several times) and ideate on their product, end users, and monetization strategies.

Dedicated pre-seed funds should be able to leverage their network and get key early design partners on board to build alongside you and provide high-quality feedback – remember, your goal at this stage is to arrive at early PMF, not revenue.

Who are all of the funds I could talk to?

A good base is to leverage crypto fundraising datasets such as Messari and list funds that invest in rounds labeled as “pre-seed” or in <$2M fundraising rounds.

You can also ping top pre-seed startups you know (or even cold outreach – there’s a relatively strong sense of community in the industry we should all take advantage of!) and ask who they chatted with to close their rounds.

Who are the funds I should be talking to?

Based on what you need at this stage of development, you can shorten the list accordingly:

What industry do you operate in?

For example, Collab+Currency has built an outstanding reputation in the NFT space, especially at this stage. We, at Lattice, have backed top entrepreneurs as early as possible with a generalist approach.Do you address a specific region and plan to grow from there?

Look for a fund with a strong presence there, especially for markets with particular customer behaviors, needs, or regulatory requirements, such as South Korea. Semantic Ventures has a big focus on Europe, for example.What do I specifically need to get to the next stage?

This is based on your strengths and weaknesses and the specificities of your vertical. If you’re building a product based on hardcore cryptography, you might need some help on the engineering front to get to a fully functional product.Who are your most direct competitors, and who are their investors?

Needless to say that you should exclude them from your target list.

What should I ask them?

Remember to onboard valuable investors in your company's first 12-18 months. Don’t take dumb money from useless investors only because they offer a maximized price.

Be upfront and ask them how they would add value. As a pre-seed-stage crypto founder, you may need different expertise depending on your vertical.

Sales and BD – pre-PMF, it's crucial to locate design partners who are friendly, able to collaborate with you in building the project, and capable of offering valuable feedback. Your investors are the best connectors to the most relevant partners. These very first commercial relationships are vital! At Lattice, we’ve helped portfolio companies grow the pipeline of early customers and partners. We’ve developed target account lists, refined outreach communication for target audiences and coordinated outreach across our industry contacts to develop a cohesive BD strategy.

Product iteration – investors can advise on approaching product iteration, such as prioritizing certain features or refining your user experience. They can also connect you with industry experts who can offer insights into your product or facilitate user testing.

Hiring – whether you’re a solo founder or a small co-founding team, your first hires are crucial. An investor can leverage his network to connect them with potential candidates, offer recruiting resources, provide guidance on appropriate compensation and equity packages, or advice on hiring best practices.

How do I maximize my chance to talk to them?

Sending cold DMs on LinkedIn, Twitter, or via generic email addresses you can find on VC websites will give you very little to no chance to hop on a Zoom meeting with funds.

Crypto startups are not scarce enough, and investors meet many startups that are:

Building solutions that look for a problem.

Chasing shiny objects without a down-to-earth approach.

Not acknowledging that creating a crypto company is a challenging task and that the journey ahead is likely to be a winding one.

Copycats of – sometimes relatively – successful ideas on EVM chains.

Inventing too complex technical solutions which have no chance to work out in practice.

No need to say that an investor can very easily get in touch with a crypto founder – each day, any respected VC gets a handful number of cold messages from founders raising funds, and a significant number of crypto startups' Twitter accounts get created. Stand out and prioritize warm introductions.

According to the consensus among investors, one of the most effective ways for individuals seeking investment to get introduced is through a portfolio founder of the investor. More generally speaking, ask your existing network, mentors, advisors, or friends if they can introduce you to the investor. We are all in an industry with (too many) events worldwide, so attend relevant conferences where investors will likely be present.

Who else could I talk to at this stage?

VCs aren't the only partners at this stage.

Consider angel investors or investment DAOs. Prominent angels offer networks, especially for go-to-market. Their association lends credibility in a limited trustworthy industry. Investment DAOs have demonstrated their ability to secure funding round allocations solely based on their extensive network and their strong reputation. As niche investment DAOs emerge, it creates intensified competition from the bottom-up, which is leading to a significant improvement in the unit economics of venture capital, which benefits founders and communities.

You could also join an accelerator/incubator program before raising a pre-seed round. Alliance has been the most successful so far. We also highly value Zeitgest, which has a laboratory approach – they build with you and dive into technical and operational obstacles coming up across the group with the support of experienced engineers/operators who have gone through the journey themselves. This mentorship can provide guidance and support for a range of business-related challenges that you would not necessarily find with traditional investors.

Joining a community of founders can make your life way easier by learning from people who are going through the same things you do. Jericho is an extensive network of high-quality founders you can tap into.

How do I conduct my due diligence process?

Due to the absence of reliable information about investors, the crypto startup industry has become focused on making sales and prioritizing investors' interests over the long-term success of the business. Unlike service providers and founders, who have contractual obligations and vesting schedules, investors are not held to the same level of accountability, despite gaining access to highly sought-after funding rounds. As a result, investors may make unrealistic promises that they cannot deliver on.

Due diligences are not only for VCs:

Find funds that have a thesis that is in line with the business you are operating – for example, we’ve been backing companies in the DePin space like DIMO or React over the last few months, along with funds like Variant or EV3.

You must ensure you onboard the best investors who fit your business well. What will they unlock? How will they help you reach the next milestone?

Look at the investors’ portfolios and try to figure out exciting synergies. Does the VC you are chatting with have a portfolio company I could partner with in the near to medium term?

If you are still unsure about the added value, you can ask for founders’ references or even contact them. You don’t know how to assess a VC’s work quality? Try to find governance proposals they wrote on public forums.

Evaluating the fund's investment process helps you stay organized – ensure you understand what kind of due diligence the fund conducts and what information it will require from you.

Acknowledging there are open questions

Founders should focus on demonstrating their vision and passion for their product rather than trying to answer every possible question a potential investor might have.

It is important that founders stay transparent and honest with potential investors about the risks and uncertainties inherent in any startup. But, as a founder, you don't need to respond ideally to every question or challenge about your startup. It's a VC's job to assume some risk. Instead, what investors want to see is confidence in your ability to handle difficulties and find solutions.

The key is approaching decisions purposefully, considering unknowns, and making thoughtful choices. It's okay to admit open questions and risks. Successful founders can evaluate the likelihood of solving challenges and quantify the value that will result once they are resolved. They should also thoughtfully budget time and money to address each significant risk and have a plan for tackling them in a specific order.

Investors don't need you to have all the answers. They need to trust you as the right person to solve the problems.

When we joined Castle’s pre-seed round in September 2021, the team was still figuring out precisely what path they would go down. Still, they thought that building at the wallet layer around the intersection of NFTs and DAOs was smart – Stephen and Ayush were still in the ideation phase, actively contributing to FWB. They ended up launching a smart wallet built for NFT collectors by helping people upgrade their wallet security practices with a multi-sig vault, portfolio tracker, and native trading features. They’re now collaborating with projects in the NFT Art ecosystem, such as Bright Moments and SquiggleDAO.

Raising the right amount of money

Beyond obvious risks of dilution and loss of control, crypto is an industry where the barrier between the public & open market and the private one is thinner than any other sector.

As a result, as Regan (our co-founder at Lattice) said, investors tend to compare private deals to liquid token prices, which can, sometimes, incentivize founders to raise more money for the same level of dilution, hence larger rounds.

More than $54B flowed into VC funds in 2022 and $19B in 2021. a16z announced a $4.5B fund in May 2022, Paradigm started deploying capital from a $2.5B dedicated vehicle, and above-500M funds have gotten relatively common over the last two years.

As funds have grown, the minimum amount of money these funds are willing to invest in a single investment has also increased. Consequently, the size of investment rounds, and therefore valuations, have grown to align with the investment strategies of these larger funds.

As a pre-seed stage founder, you must be aware of these parameters. The biggest funds have been launching initiatives targeting the earliest stages – a16z relaunched its Crypto Startup School, and Paradigm announced a Fellowship program in May 2022.

Successful companies in their respective categories can raise large amounts of funding because it is more efficient for investors to invest significant amounts of capital into the market leader.

Even if these are becoming less relevant today, there are plenty of reasons why you, as a founder, could be tempted to raise large rounds. But you need to exercise caution when raising excessive amounts of capital. Doing so can create an unwieldy burden of resources, including a large team and customer base, making it difficult to change direction or shut down if necessary. It can also result in investors needing to be aligned with the company's vision and strategy, making it harder to achieve goals and secure future funding.

Some people would tell you that you should raise only $1M if you still need more certainty about your long-term motivation and the market opportunity.

Only raise what you need to reach your next milestone, but not so much that it creates unnecessary pressure to scale too quickly or distracts from building a sustainable business.

Startups that raise too much money often have a bloated team, a high burn rate, and unrealistic expectations, leading to a high failure rate.

Picking a small market and growing from there

Instead of having too much money on their balance sheet with no idea of PMF, founders should select a niche market segment they have confidence in serving effectively and expand their business. This is a widely used principle in Web2 that Web3 founders tend to forget – Peloton focused on a specific customer segment (affluent fitness enthusiasts) who wanted the convenience of working out from home without sacrificing the quality of their workout.

The ultimate key is to narrow your focus on a particular customer and provide an unparalleled solution to their problem. This should be at the core of your pitch to VCs at this stage.

Once you become the unrivaled problem-solver for that customer, your market will inevitably broaden – this is the only way to build through multiple cycles in crypto.

Layer3 initially came out of the Rari Capital community, which became their first customer. From this specific use case, they showed that the demand was strong and the market was expanding. Based on this initial traction, the team raised their first funding round to become the best place for protocols and DAOs to reach, acquire, and retain users.

Similarly, IYK noticed that many brands entering the NFT space were not issuing NFTs meaningfully from the consumer perspective. So they started as a services business, working on deep engagements with top brands (e.g., VÉRITÉ created a crewneck and partnered with IYK to embed a chip into the sleeve). They’re now dedicated to creating an agnostic, modular, and extensible platform layer that enables brands and agencies to build in the digi-physical realm.

As the space matures, the era of “build it, and they will come” is dead – find a market niche, build along with early strategic partners, iterate, repeat, and raise your first funding round based on these first experiments.

Adjusting to investors' schedules

Investor availability is often overlooked – most US investors are on vacation through the first week of January. They are less responsive to emails and less likely to take meetings, which could slow the process. Thanksgiving until the end of the year is a dead zone in the United States. But it’s also recommended to utilize the period between November and December to give careful attention to developing your story and presentation materials. This time can be used to initiate contact with potential investors and secure a spot on their schedule for January before the high volume of inquiries and competition for attention sets in.

Good times to raise are generally Q1 and Q3, while August (especially in Europe) can be a challenging period as many investors are off.

Of course, the timing of a fundraising round will ultimately depend on many factors specific to each company, and the crypto industry is made of many sudden events that can significantly impact how investors deploy their capital. But on the whole, understanding investor availability can help founders plan their fundraising efforts strategically and increase their chances of success.

Also, remember that a slower and less competitive process provides a natural advantage for VCs – they can set the pace and timeline for the due diligence process, negotiate, close the deal, and be given more negotiating power.

Getting back to stealth mode

After raising a pre-seed round, startups should focus on building stealthily because it allows them to maintain a sense of privacy and control over their company's development. By keeping a low profile, you can focus on developing a product, refining your strategy, and building out a team without external distractions.

Building stealthily can help you avoid premature scaling and premature exposure to potential competitors. When a startup is in its early stages, it's crucial to prevent overextending oneself and focus on creating a solid foundation. By staying under the radar, you will avoid unwanted attention from competitors or investors who may pressure you to grow too quickly.

Remember, crypto is still a niche industry with an immense sense of mystery – you can create exclusivity and intrigue around a product or service by remaining lowkey. This can help generate interest and anticipation among potential customers and investors, leading to greater buzz and excitement when the startup finally does launch.

At this stage, you must operate with freedom. You need the time and space to develop your ideas and build your business on your terms. The market evolves quickly, and you must be very flexible — people love, hate, or need different things every month, and it’s hard to predict or plan for.

Caveats

This is not an exhaustive guide for founders seeking to raise a pre-seed round in the crypto industry. Success is not guaranteed by following these tips alone. Ultimately, having a unique, well-defined vision, the right team, and market timing is crucial. Without these, the fundraising process may prove challenging.

These views are based on our own experience as early-stage investors. We don’t pretend to possess omniscient knowledge; other VCs could question some of these assumptions.

At this pre-seed stage, you must convince a limited group of firm believers aligned with the mission and the values, onboard them, get the most out of this syndicate on strategic topics for the first 18 months, and get back to building. Anything else is a distraction.

This is not legal or financial advice. Lattice is an investor in Layer3, IYK, and Castle.

If you enjoyed this LFB edition, please click the ❤️ button on this post so more people can discover it on Substack, comment below if you have any feedback, and share it on Twitter if you found it useful.

--

Let’s fucking build with the support of our partners Ledger Cathay Capital & Lattice,

Pierre from Lattice & Vlad from Jericho

great write up!