🇪🇺 European web3 VC landscape

We gathered data from 170+ European VC funds incl. fund types, verticals, lead ratios & # of investments.

Jericho is the land of web3 founders. Meet, learn & build with 400+ hand-picked founders from 40+ countries who raised $450M in total from tier one VC funds.

This “Let’s Fucking Build” edition is brought to you by our two amazing partners:

Lattice is an early-stage crypto VC that helps founders build defensible moats. They write $500K-$1.5M checks into early Web3 companies. Portfolio: 50+ crypto companies including Immunefi, Layer3, and Project Galaxy.

Ledger Cathay Capital is a brand new €100m investment fund for Web3 entrepreneurs at Seed & Series A stage. They offer entrepreneurs the value of a leading global investment platform combined with the support of the world-leading Web3 security platform.

170+ European web3 VC funds

We gathered data from 170+ European web3 VC funds using their websites and Crunchbase profiles. We qualified the funds using the following fields:

Fund type: Is the fund web3 native, is it a web2 fund investing in web3, or is it a web3 company’s venture arm?

Investment stage: Does it mainly invest in early stages (pre-seed, seed), across stages, or only in later stages (Series A & above)?

Vertical: Infrastructure, Exchanges, DeFi, NFT, DAO, Gaming

Web3 investments: The number of web3 companies they’ve invested in

Lead ratio: The percentage of investments where the fund led the round

Investments include: 3 examples of companies they’ve invested in

You can find the full list of funds here. Feel free to download the CSV for your use.

Mapping methodology

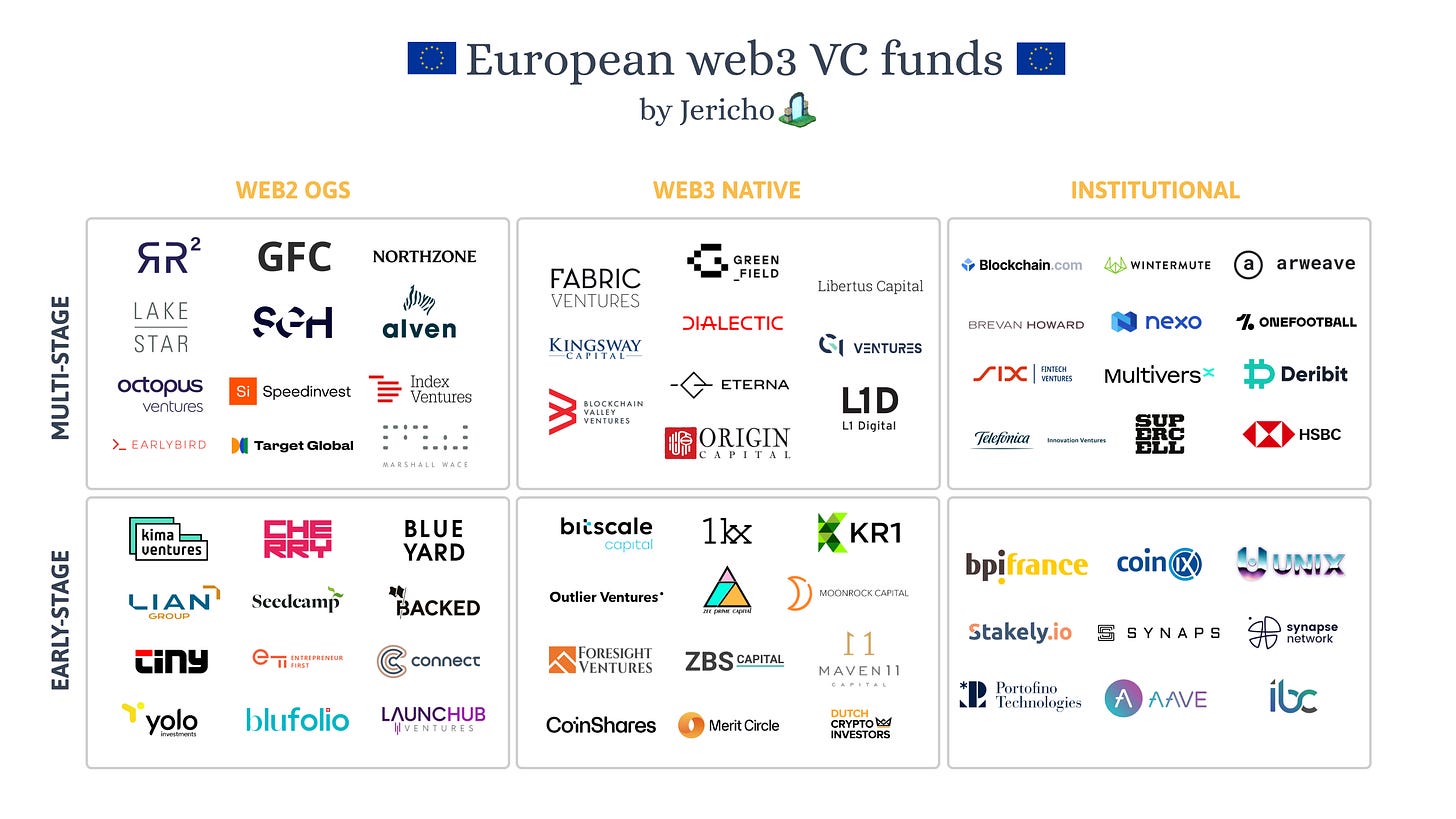

From this comprehensive list, we decided to do a visual mapping.

The mapping is based on two factors:

Is the fund investing early-stage or across stages? We removed the late-stage-only funds because there weren’t many of them. Plus, web3 is a relatively young industry where early-stage capital is needed more than growth capital.

What is the fund type (Web3 native, Web2 OGs, Institutional)?

Assessing the performance of the funds was impossible due to a lack of data. For the mapping, we decided to select the most active ones per category (# of web3 investments).

This is a map, not a territory. We probably forgot some funds & made some mistakes in the process. If it’s the case, please ping on Twitter.!

If you enjoyed this LFB edition, please click the ❤️ button on this post so more people can discover it on Substack, comment below if you have any feedback, and share it on Twitter if you found it useful.

--

Let’s fucking build with the support of our partners Ledger Cathay Capital & Lattice,

Vlad from Jericho

Impressive work!

Well done!

Don't forget about https://blockchain-founders.io/ and bfc.vc please :)